- #Three steps of accounting process software

- #Three steps of accounting process trial

- #Three steps of accounting process series

#Three steps of accounting process trial

To prepare the trial balance, you need to compile data from all ledger accounts.

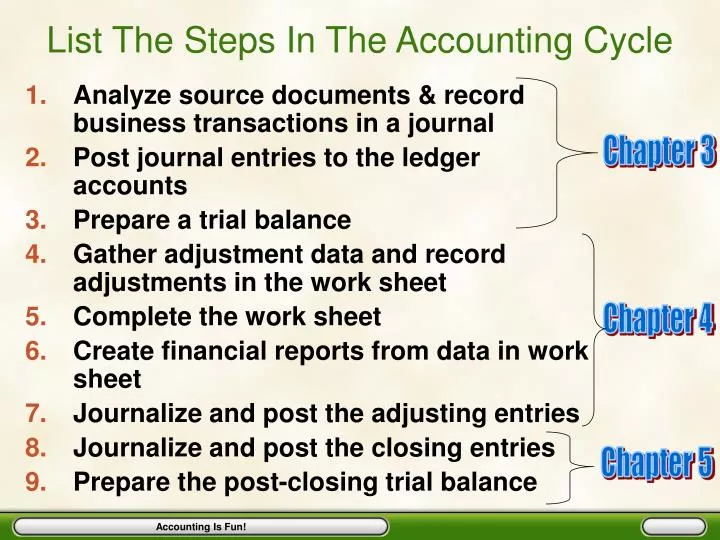

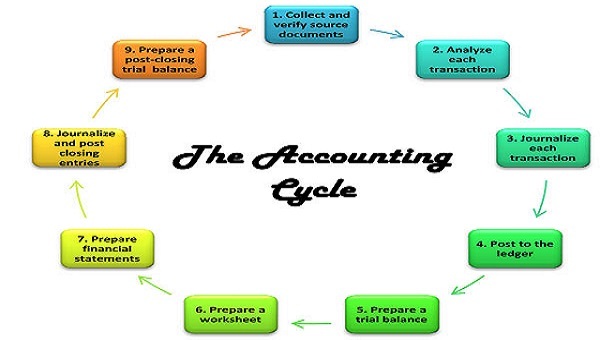

Even if the unadjusted trial balance is balanced, you must conduct step five as other errors may have occurred.Įxample: To keep this simple, let’s prepare a trial balance for one day while ignoring Cost of Goods Sold. A trial balance is considered successful if the debit account balances equal the credit account balances. The unadjusted trial balance is prepared so that accountants can catch any errors that may have occurred during the initial stages of the accounting cycle. This trial balance is also called “the unadjusted trial balance” because it is prepared before adjusted entries-step six-being entered. Prepare an unadjusted trial balanceĪt the end of each accounting period, a company's accounting department should enter the data from the ledger accounts into a trial balance. Companies differ in how they track refunds, but let’s assume the summarized Sales Revenue transactions would be a credit of $500 with a summary of a debit of $100 recorded in Sales Returns and Allowances-a “contra account,” which means it offsets a regular revenue account and has a debit balance. When you post to the general ledger, you record a summary of the activity for each ledger account.Įxample: If today’s transactions included a cash sale of $300, a cash sale of $200 and a cash refund of $100, then the summarized Cash transactions would be a debit of $400. The general ledger keeps track of a company's entire financial activity. The general ledger is the master set of all ledger accounts. Post entries to the general ledgerĪ ledger account is a collection of all journal entries that debit or credit that account. A $300 cash sale will involve a Debit of $300 to Cash and a Credit of $300 to Sales Revenue. The person entering the transaction data into the journal entries must make sure that the debits and credits are balanced.Įxample: The $300 transaction is entered based on the date it occurred to align with the chronological order of the other transaction entries. Whether an account is debited or credited is determined by how the balance of that account is tracked.įor example, cash and receivable accounts have debit balances-increased with debits, decreased with credits-and revenue accounts have credit balances-increased with credits, decreased with debits.

You need to understand the impact of the transaction-from step one-to create the journal entry.Ī journal entry has a debit and a credit which relates to how a transaction affects different accounts. This should be done by following a chronological order. The next step in the accounting cycle is to record these financial transactions as journal entries. Read more: 7 Effective Methods for Analyzing Data 2. This is the starting point of the accounting cycle for this transaction.

#Three steps of accounting process software

Transactions are the starting point from which the rest of the accounting cycle will follow.Įxample: A company receives $300 in sales on their software products. Events that are not considered transactions include creating purchase orders and signing contracts.

Transactions include any company purchases that were made, debts paid, debts acquired or revenue acquired from sales. The first step in the accounting cycle is to analyze events to determine if they are “transactions” and what their impact is.

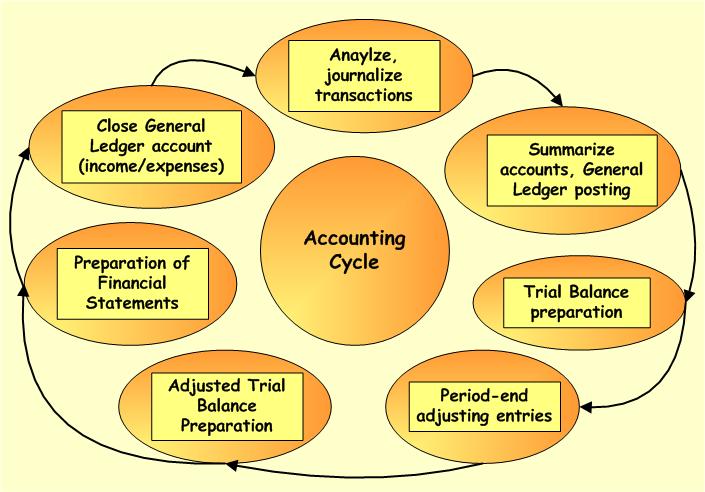

Steps one through seven occur every accounting period-regardless of length-while step eight only occurs at the end of the fiscal year: 1. The accounting cycle consists of eight steps that accountants should follow to record transactions and check for data accuracy. Related: Accounting: Definitions and Specializations The eight steps of the accounting cycle This process is important as it guarantees precision and accuracy throughout a company's fiscal years. The hard close process moves transactions from temporary accounts-accounts on the income statement-to permanent accounts, which are accounts on the balance sheet. This occurs so that financial documents can be prepared for that period without the account balances changing. The final step-the closing process-can occur as a “soft close” throughout the fiscal year, but a “hard close” only happens at the end of the fiscal year.Ī “soft close” closes the general ledger for that accounting period so that new journal entries can’t be booked. The accounting cycle happens every accounting period or reporting period for which financial documents are prepared. The cycle follows financial transactions from when they occur to how they affect financial documents.

#Three steps of accounting process series

The accounting cycle is a series of steps used by an accounting department to document and report a company's financial transactions. In this article, we discuss the eight steps of the accounting cycle process with examples and explain how it differs from a budget cycle. By learning the necessary processes and terminology of accounting, you gain fundamental knowledge of a company’s finances.

0 kommentar(er)

0 kommentar(er)